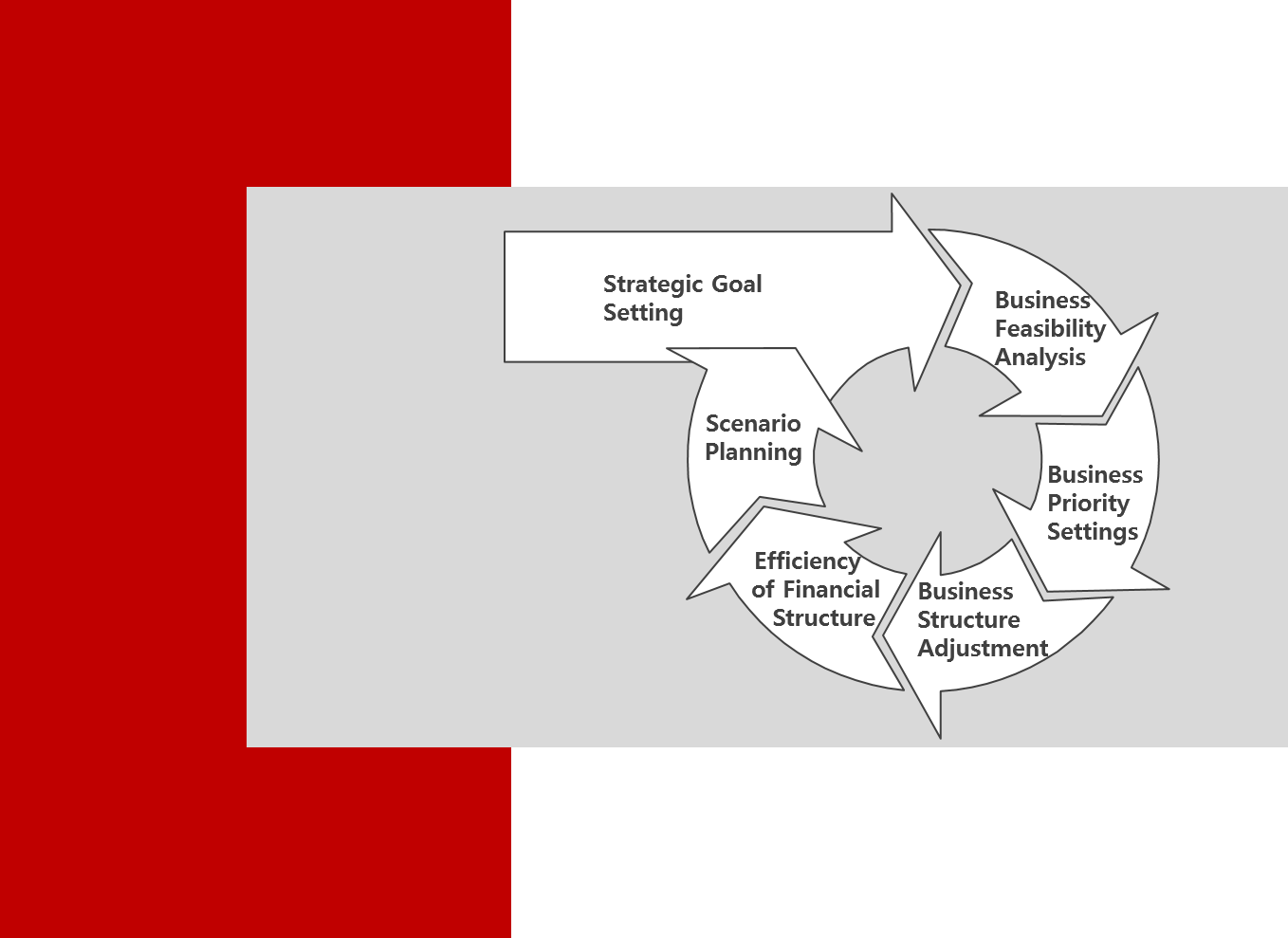

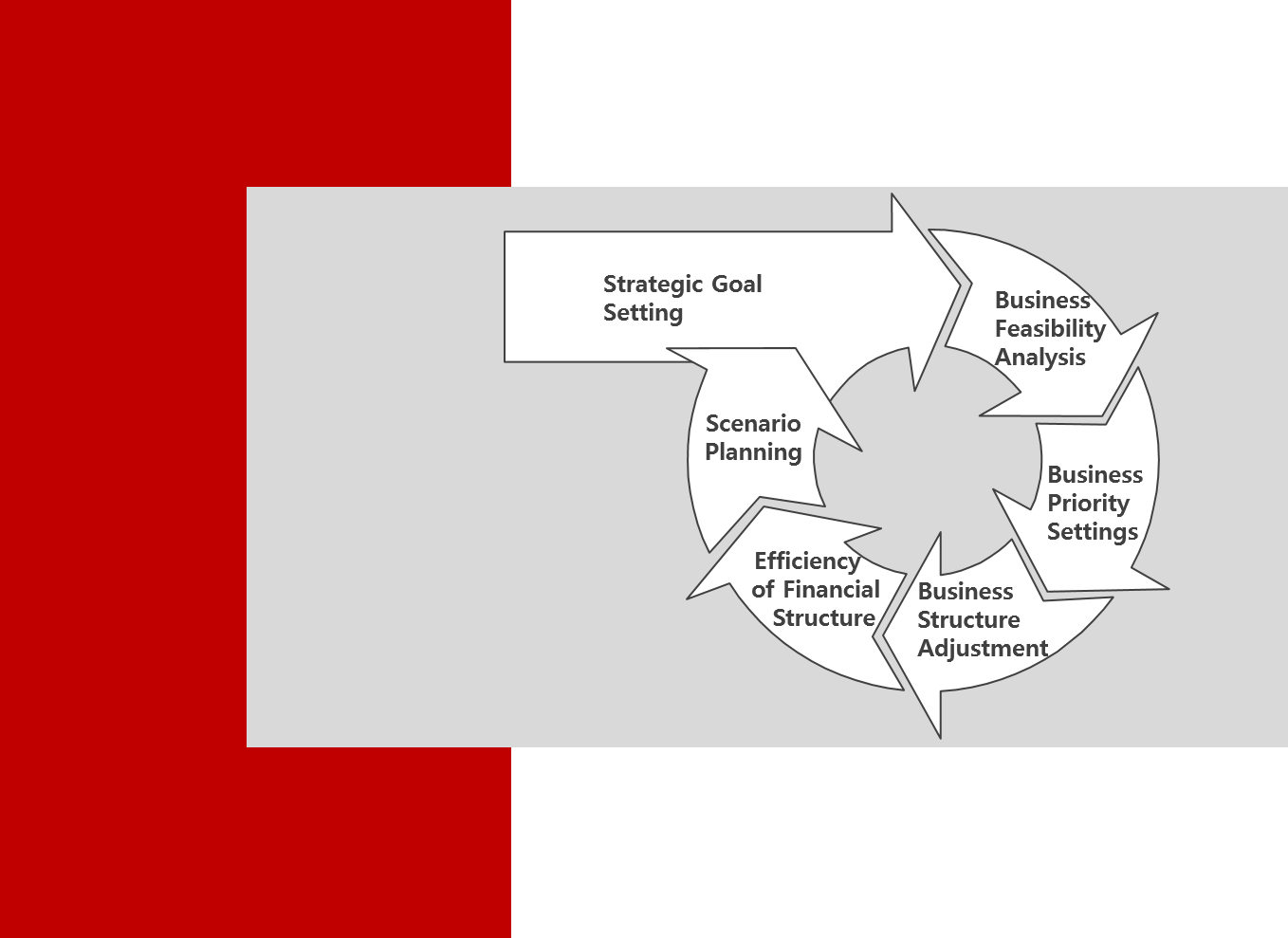

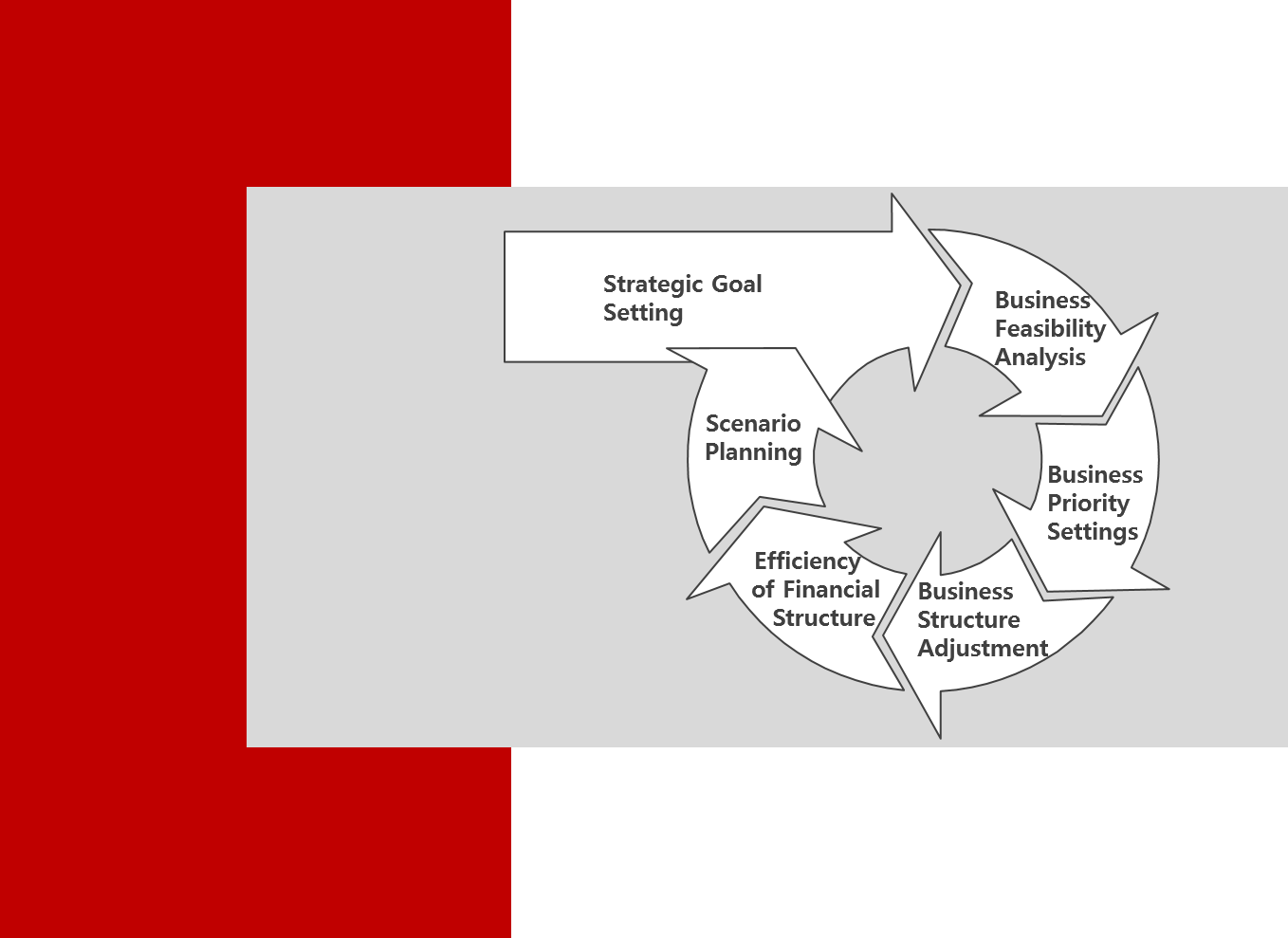

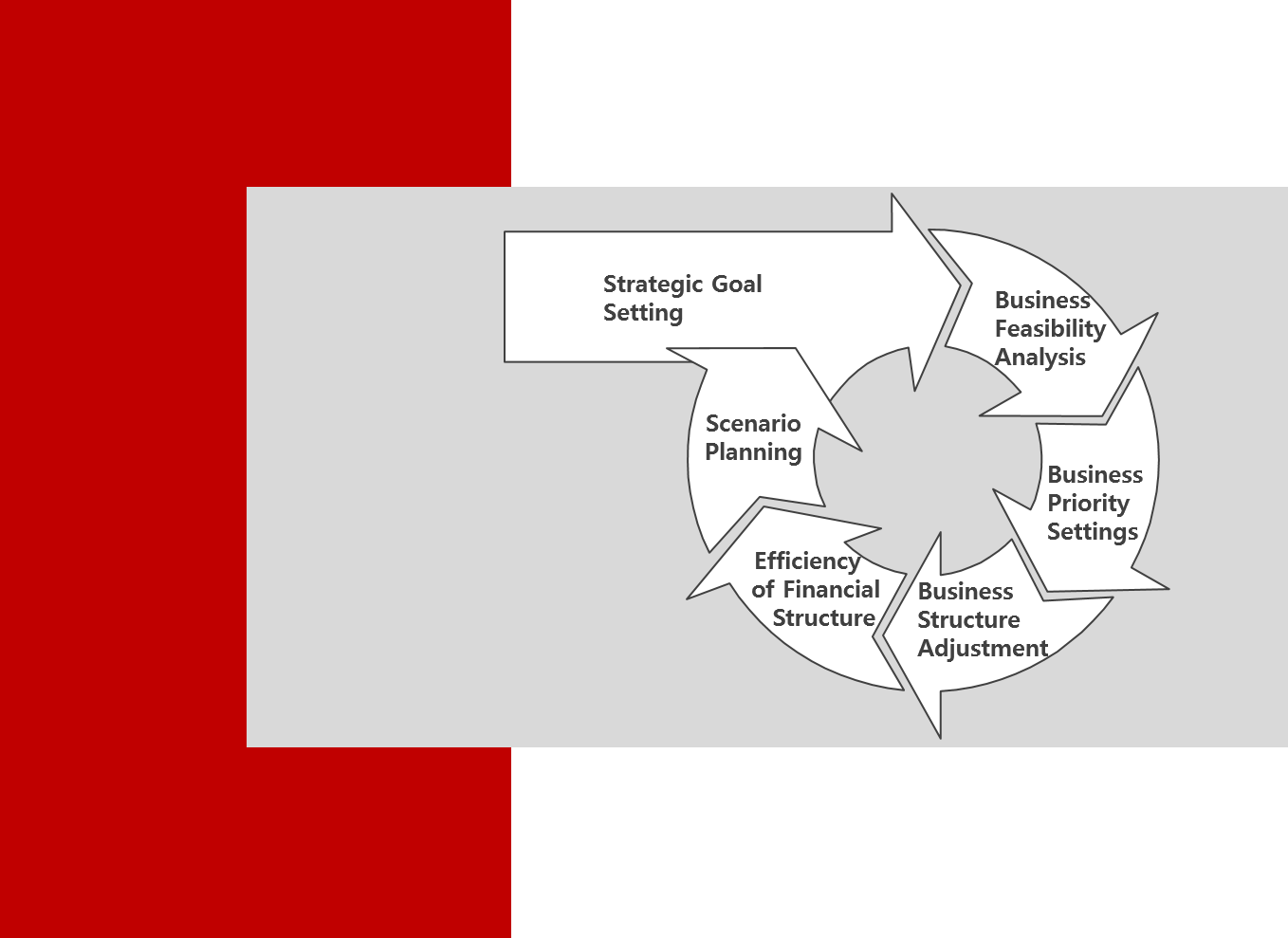

Why FSM(Future Strategy Management)?

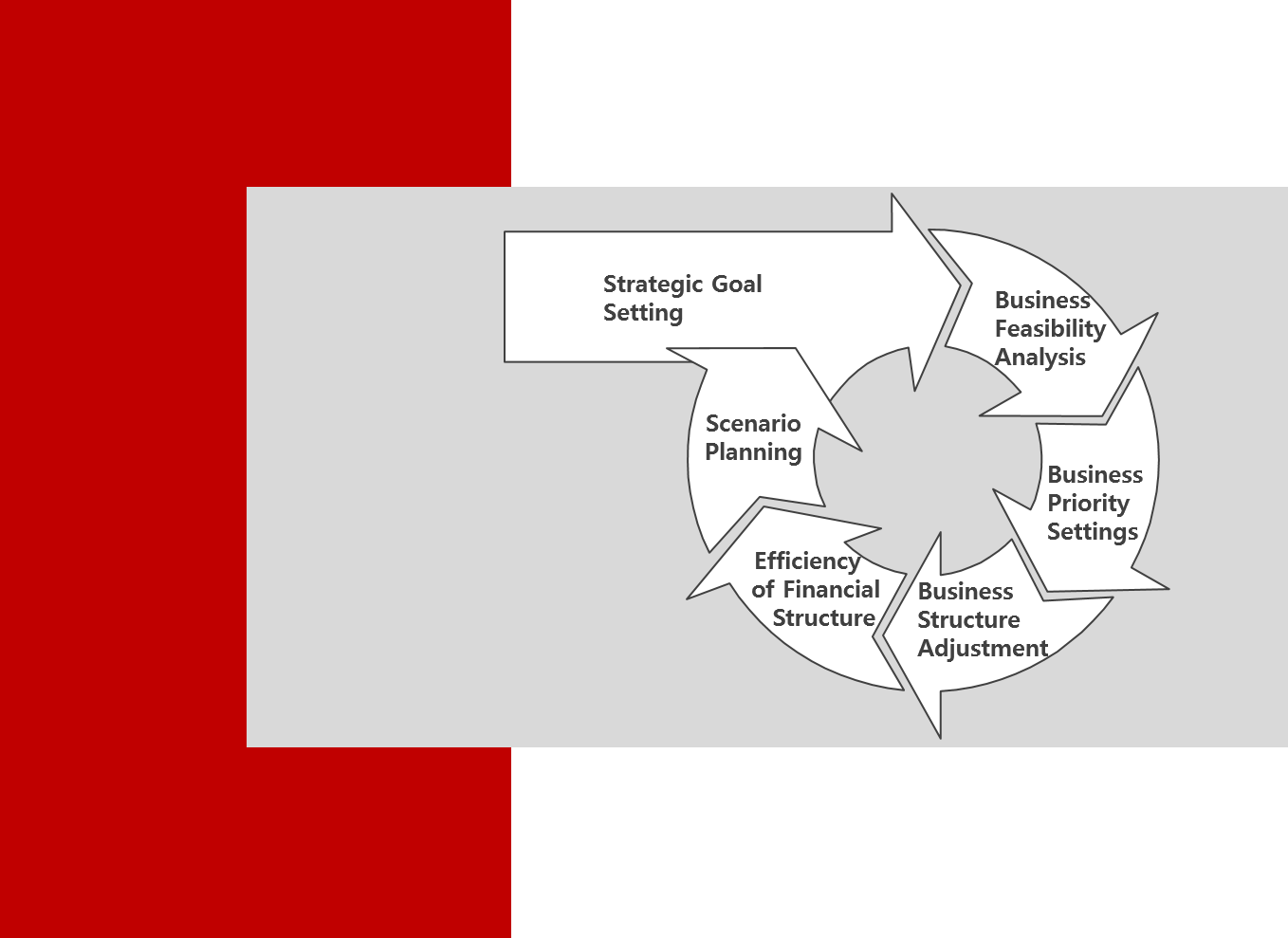

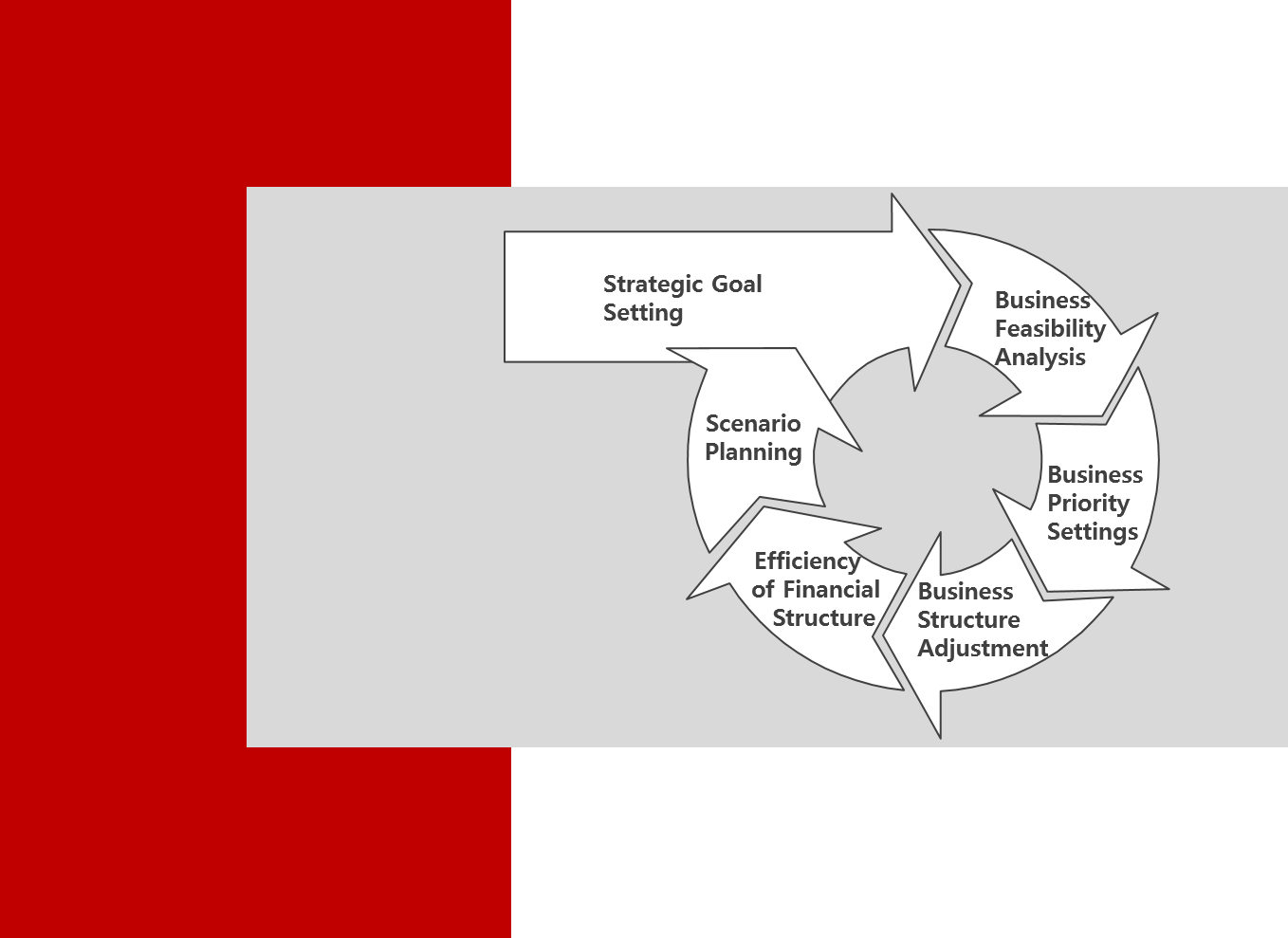

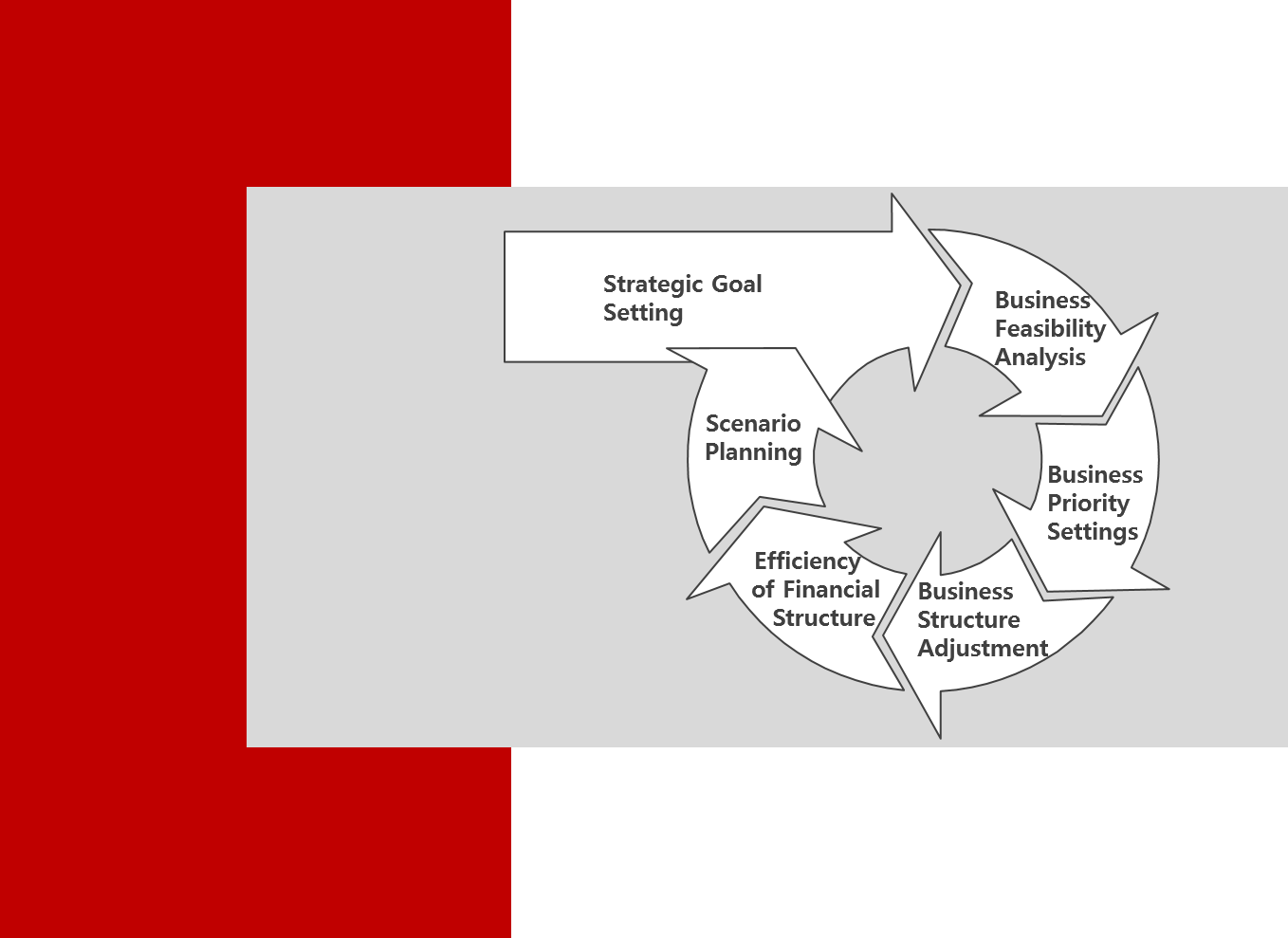

Future strategic management = mid- to long-term goal management + business portfolio optimization

FSM Framework

FSM Main Function

- Strategic goal linkage: Business goal/Financial goal

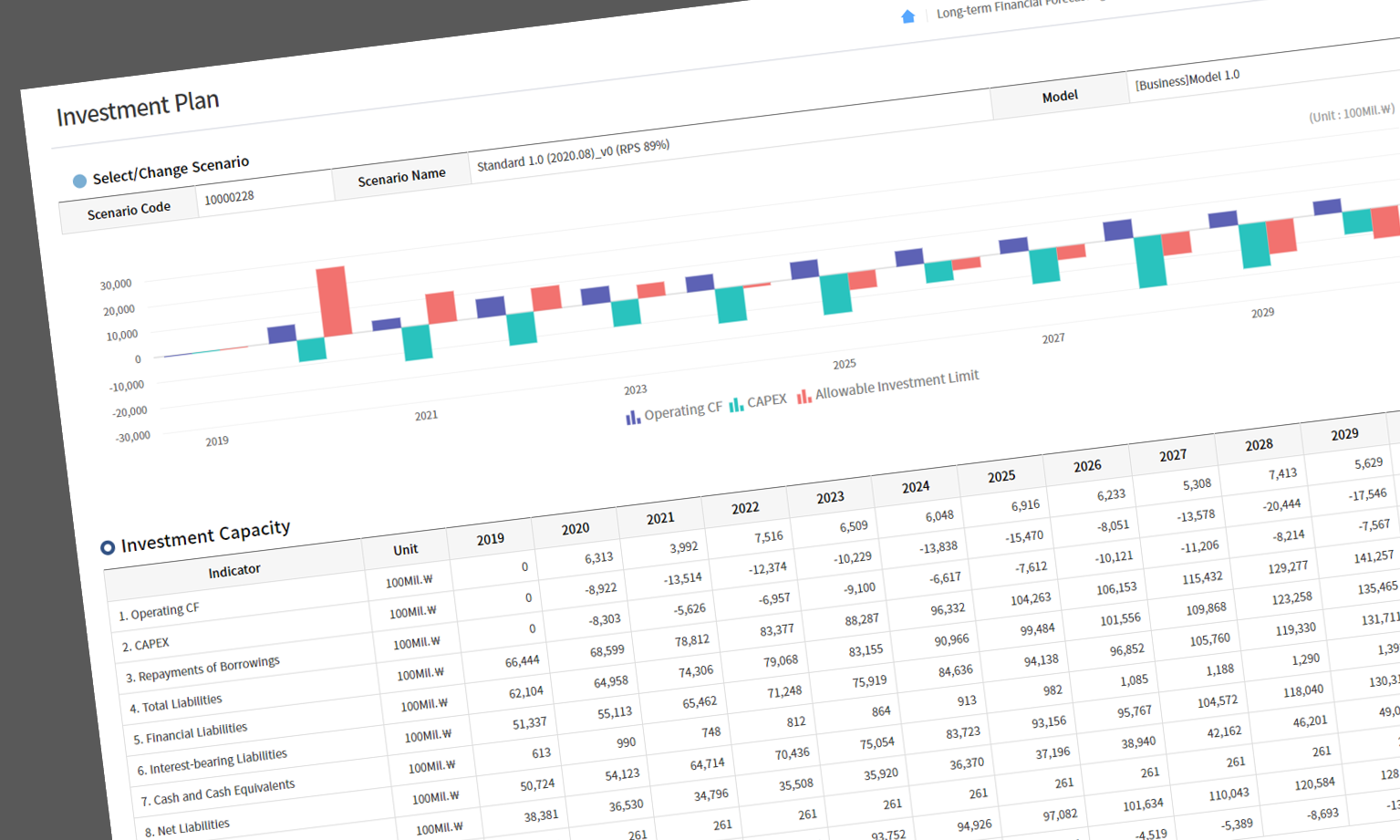

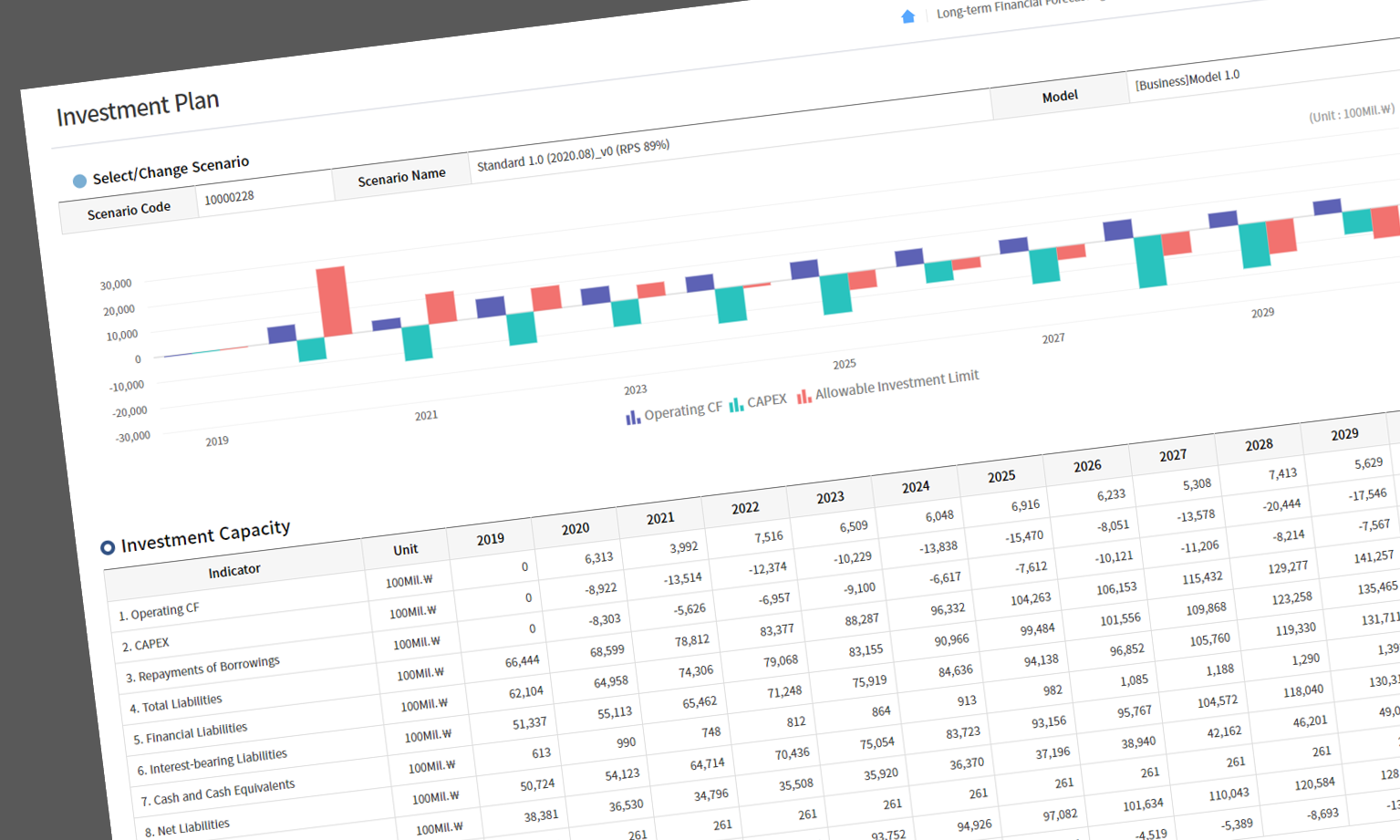

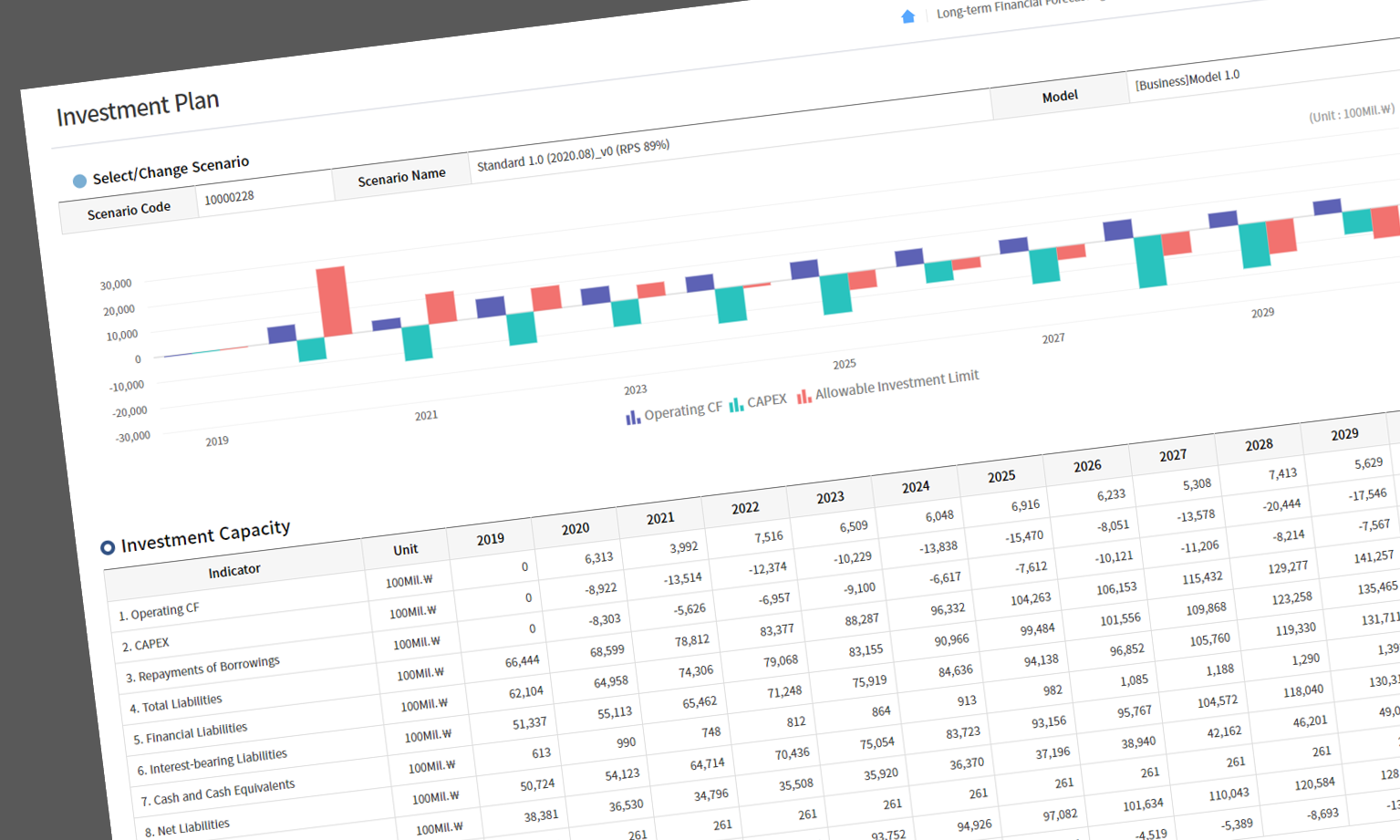

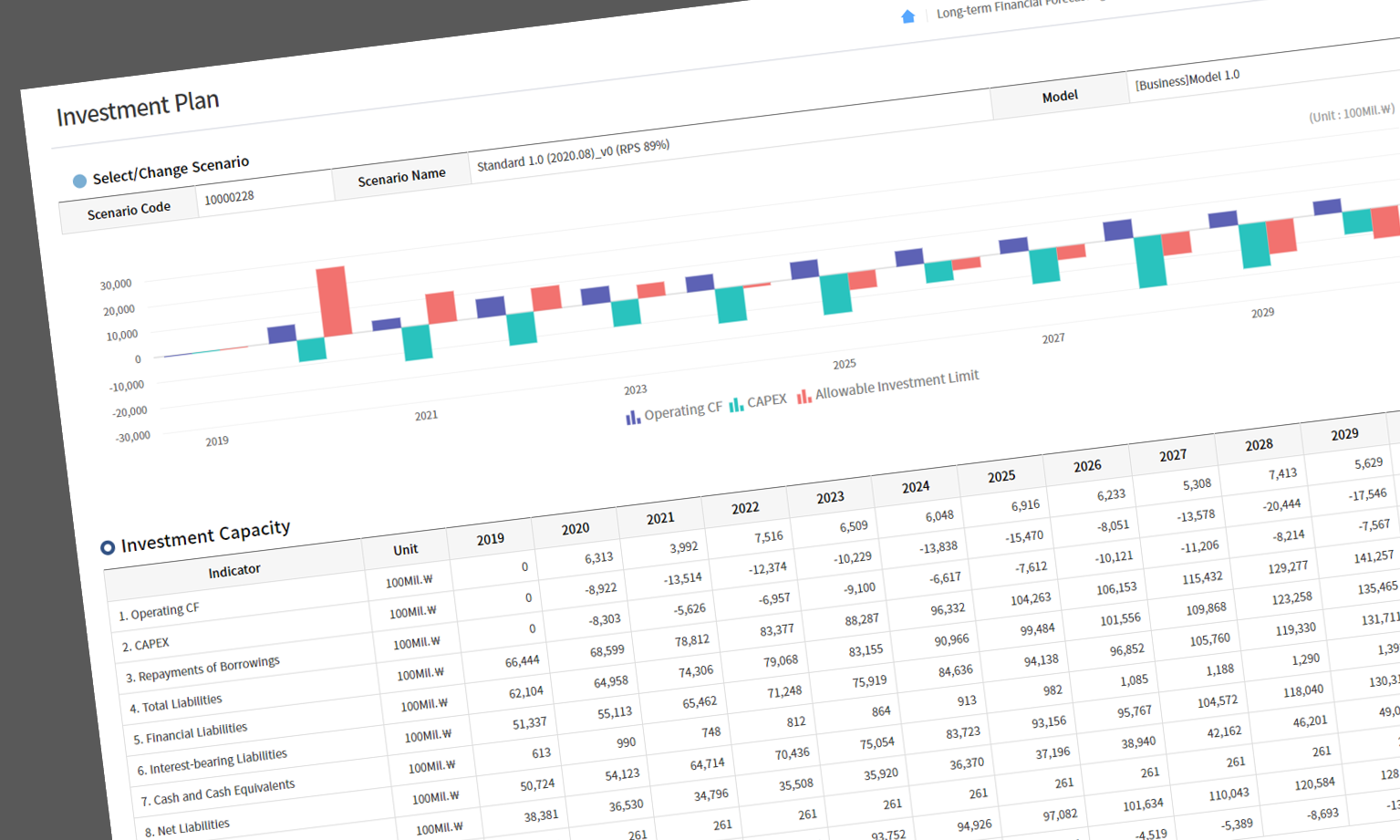

- Investment plan prediction: CAPEX/Investment capacity

- Financial plan prediction

- Monitoring whether goals are achieved by financial management indicators

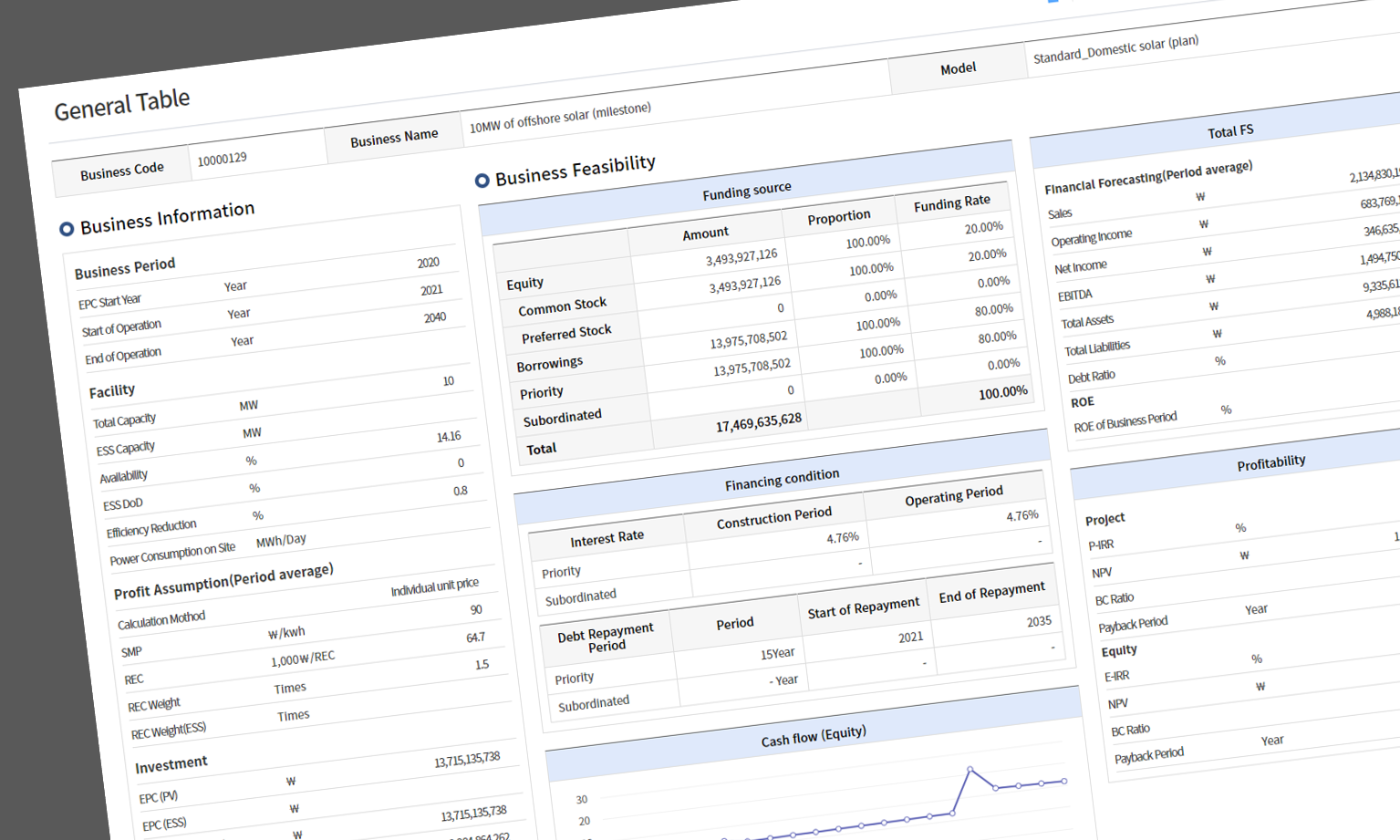

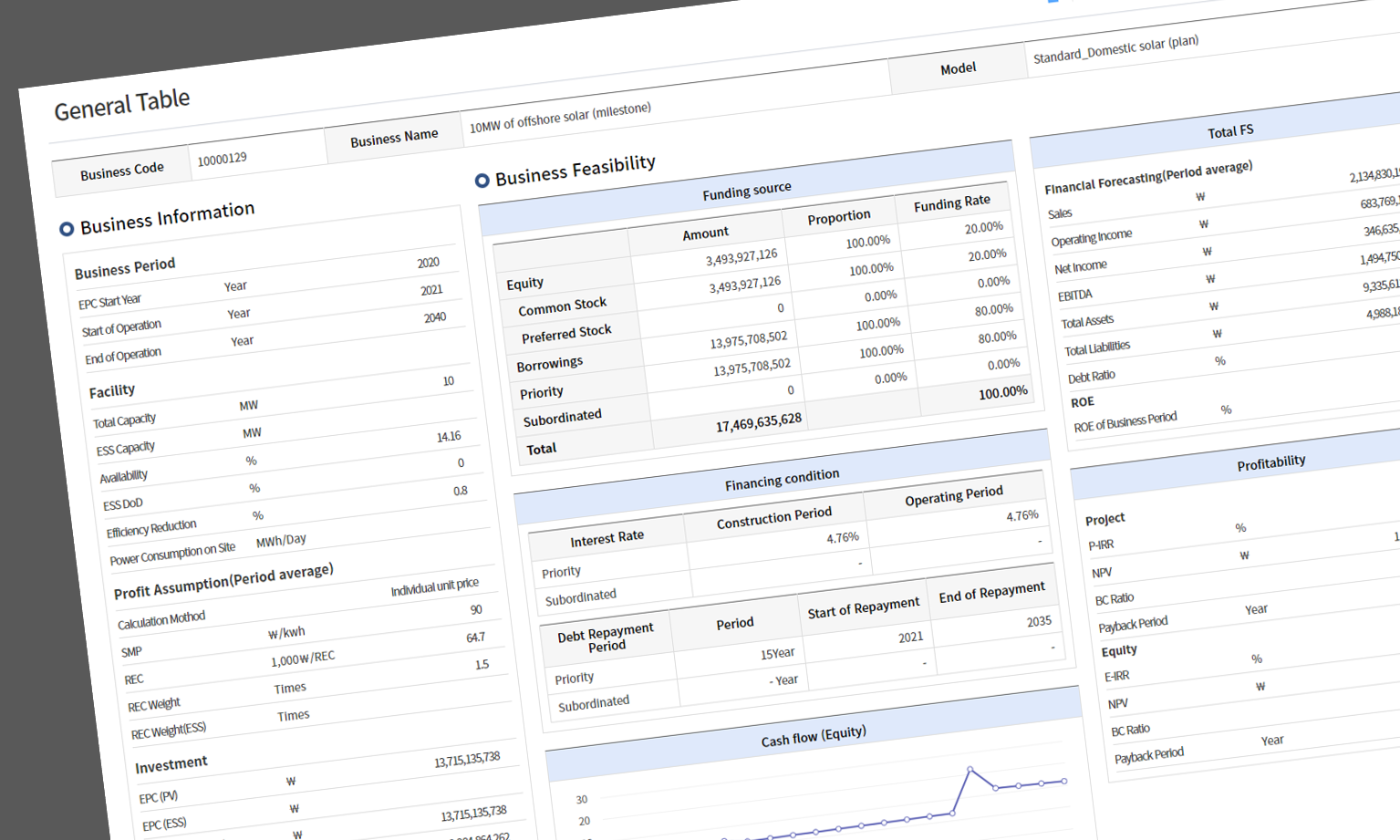

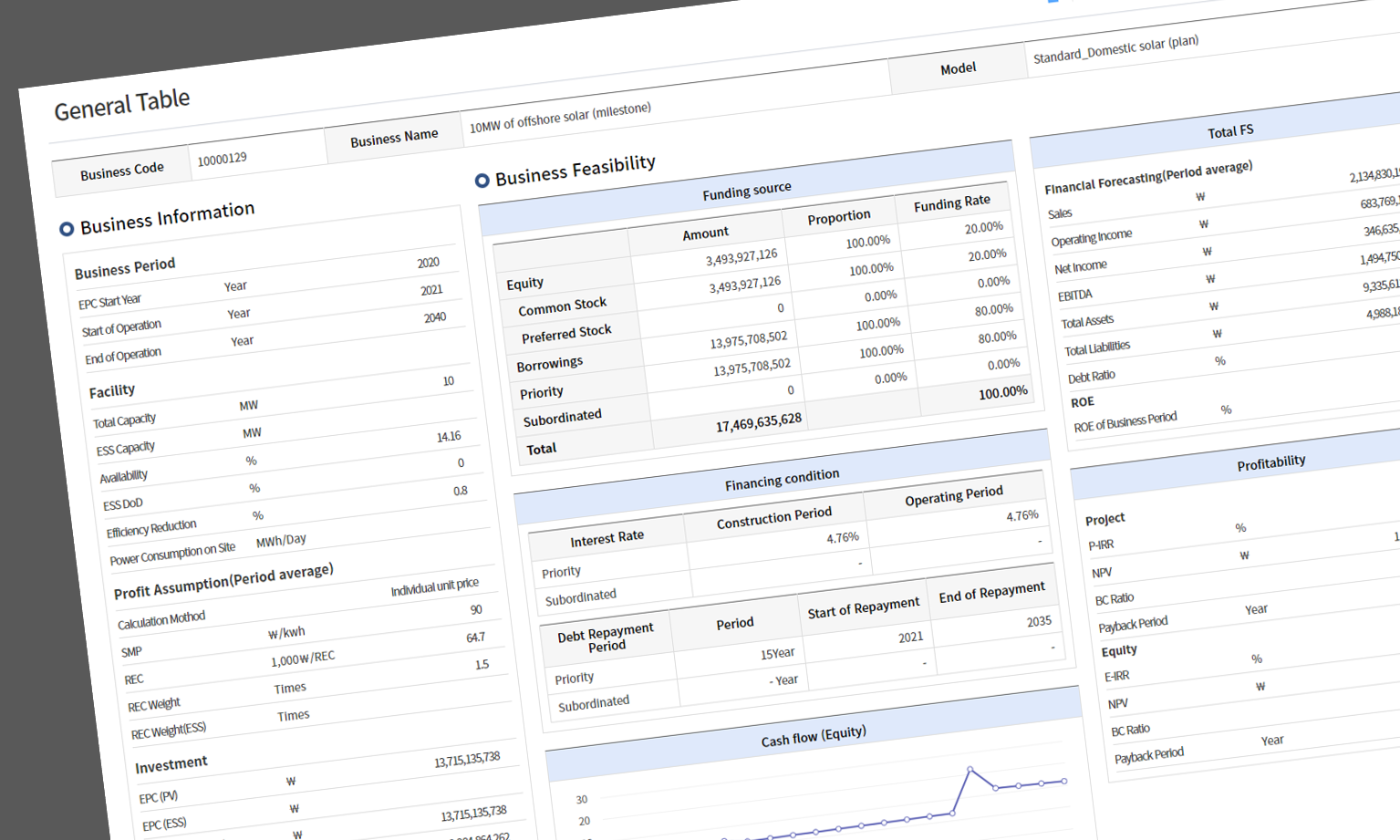

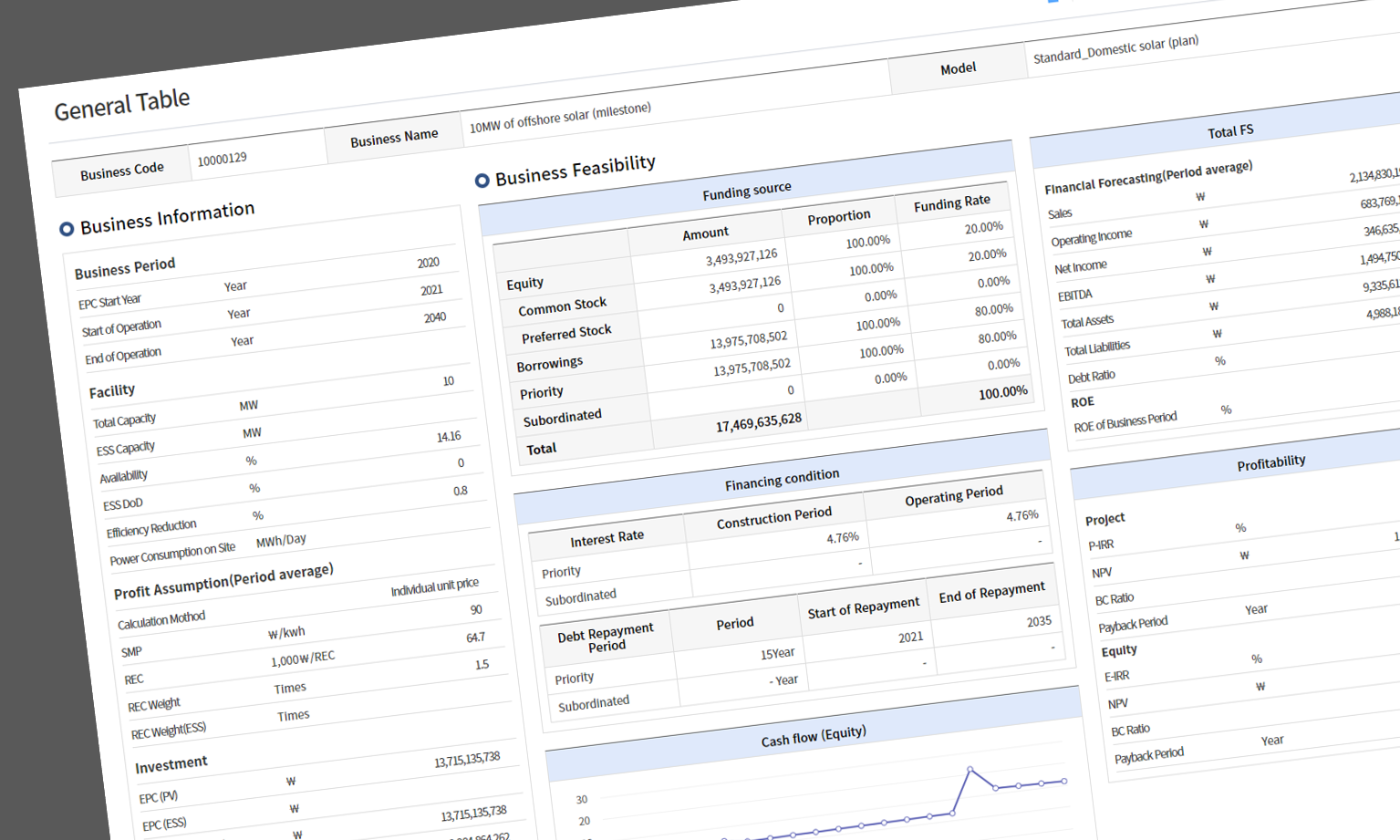

- Check basic information for each investment business Business

structure/profit assumptions/investment costs/financing

- Check the results of financial forecast by business

Check the results of financial forecast by business Cash flow/estimated financial statement

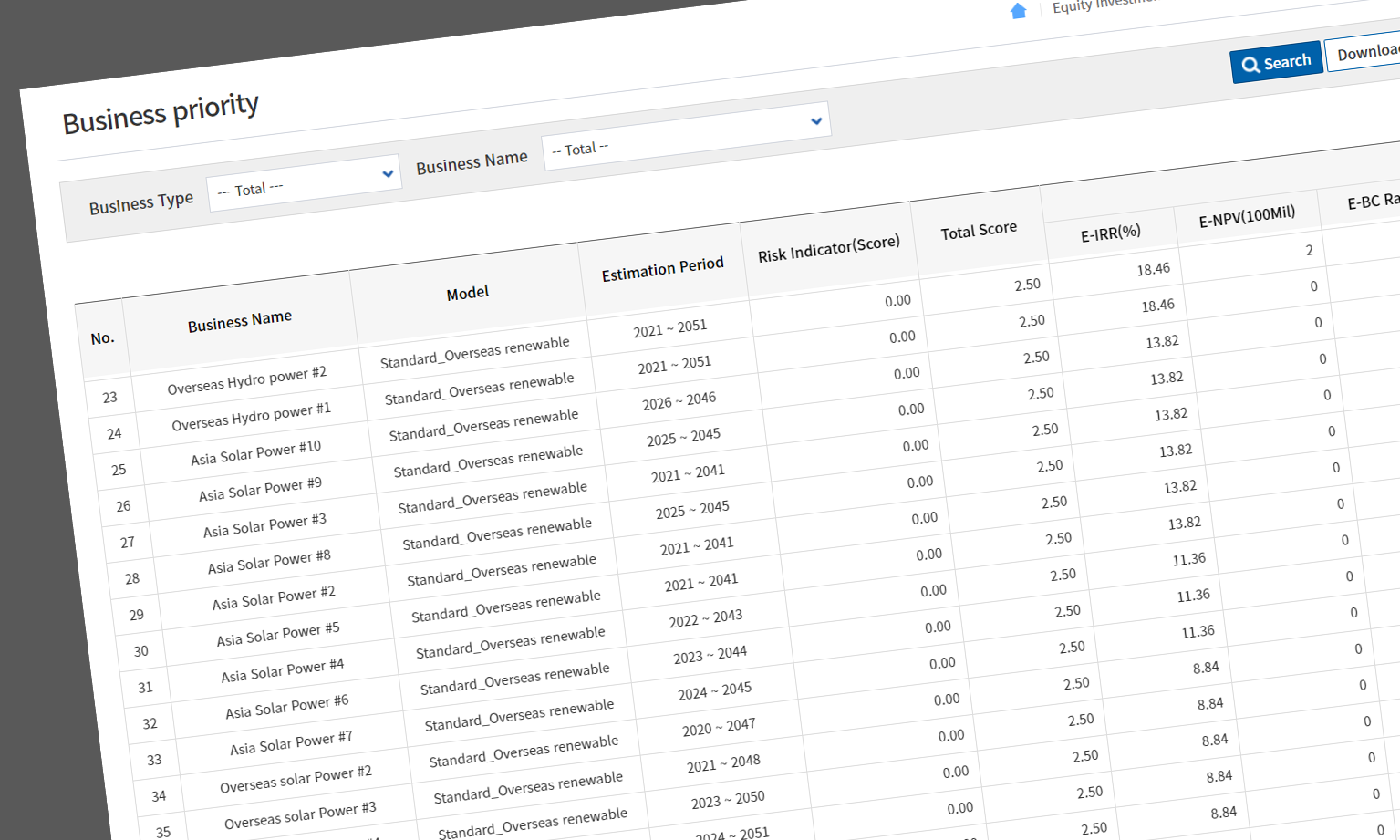

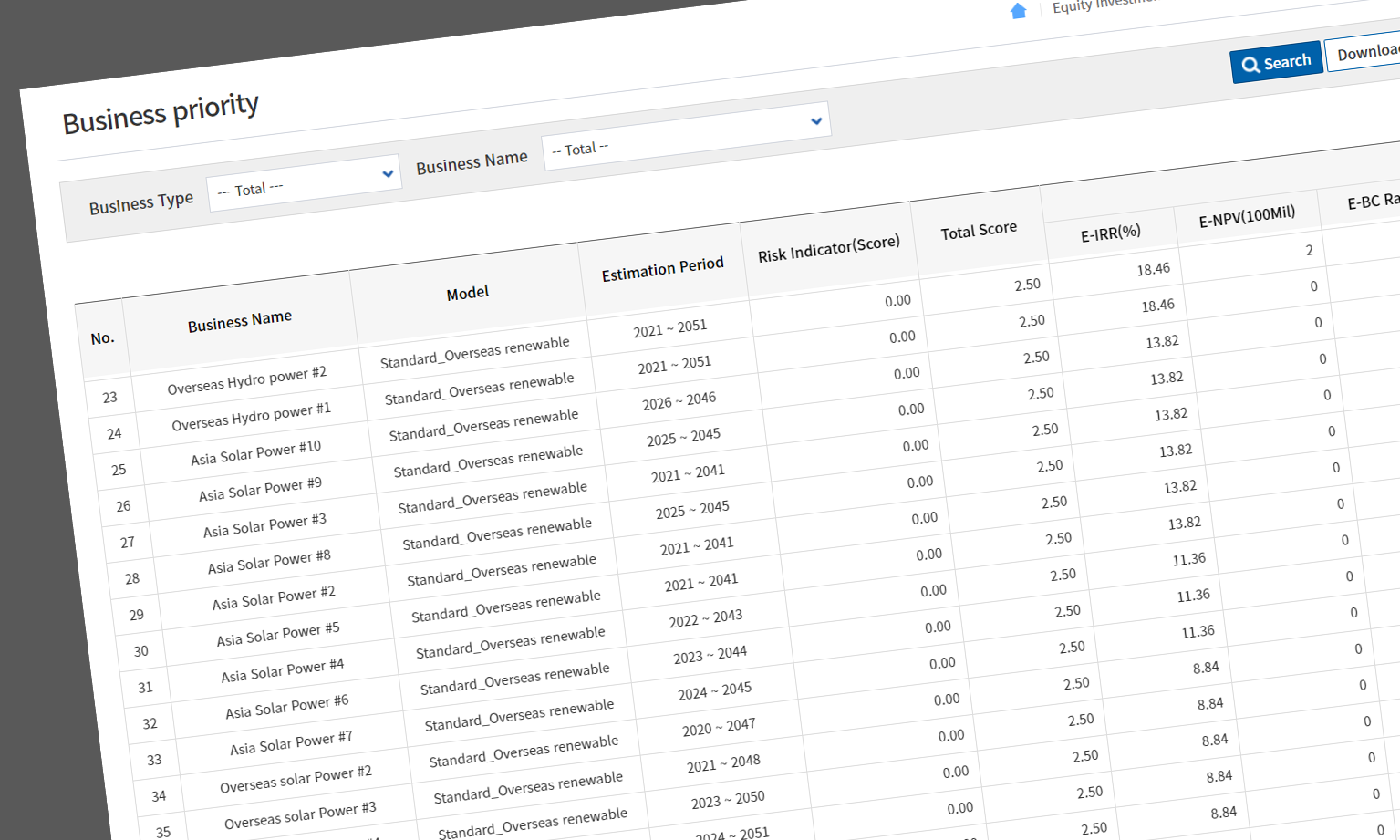

- Business Feasibility Analysis: IRR/NPV/BC Ratio

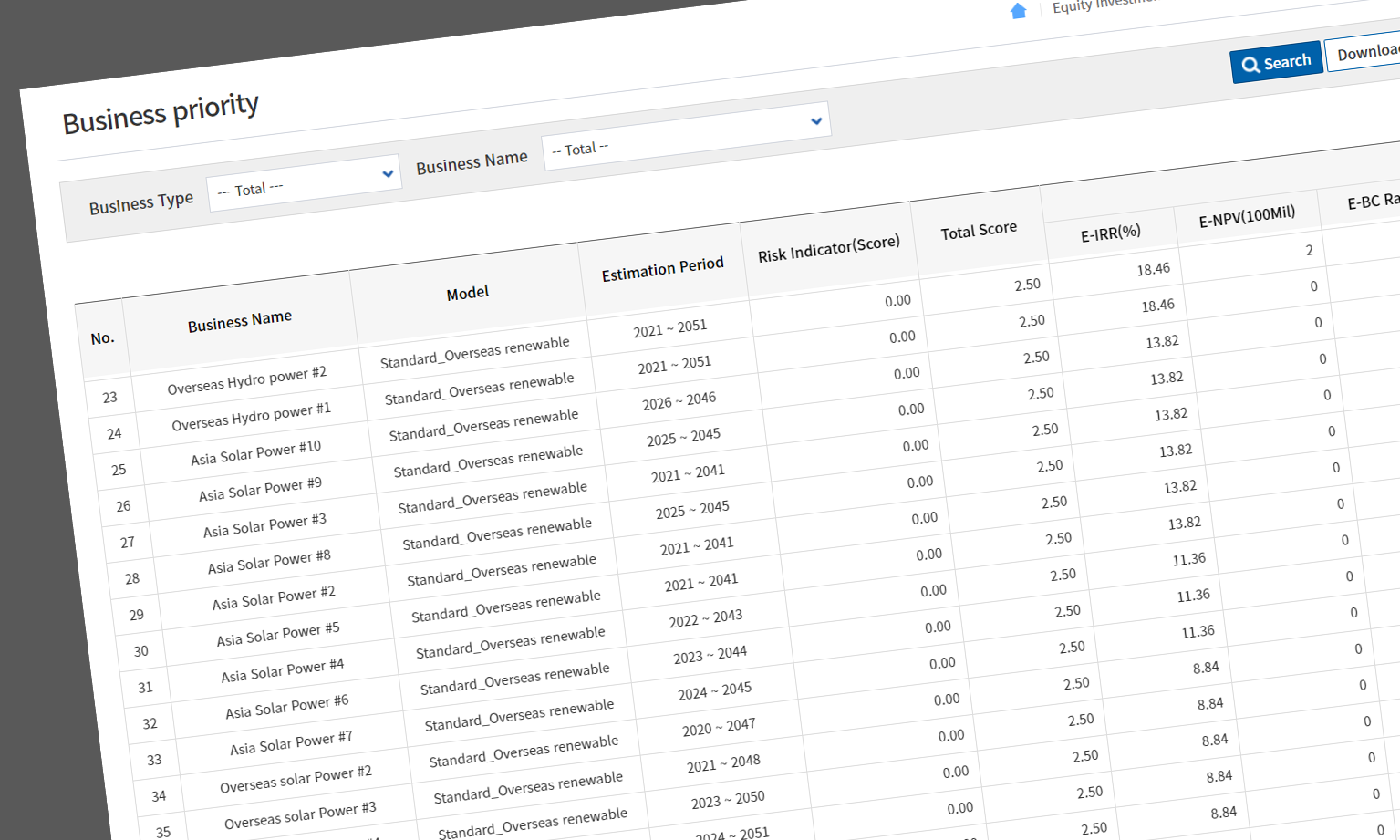

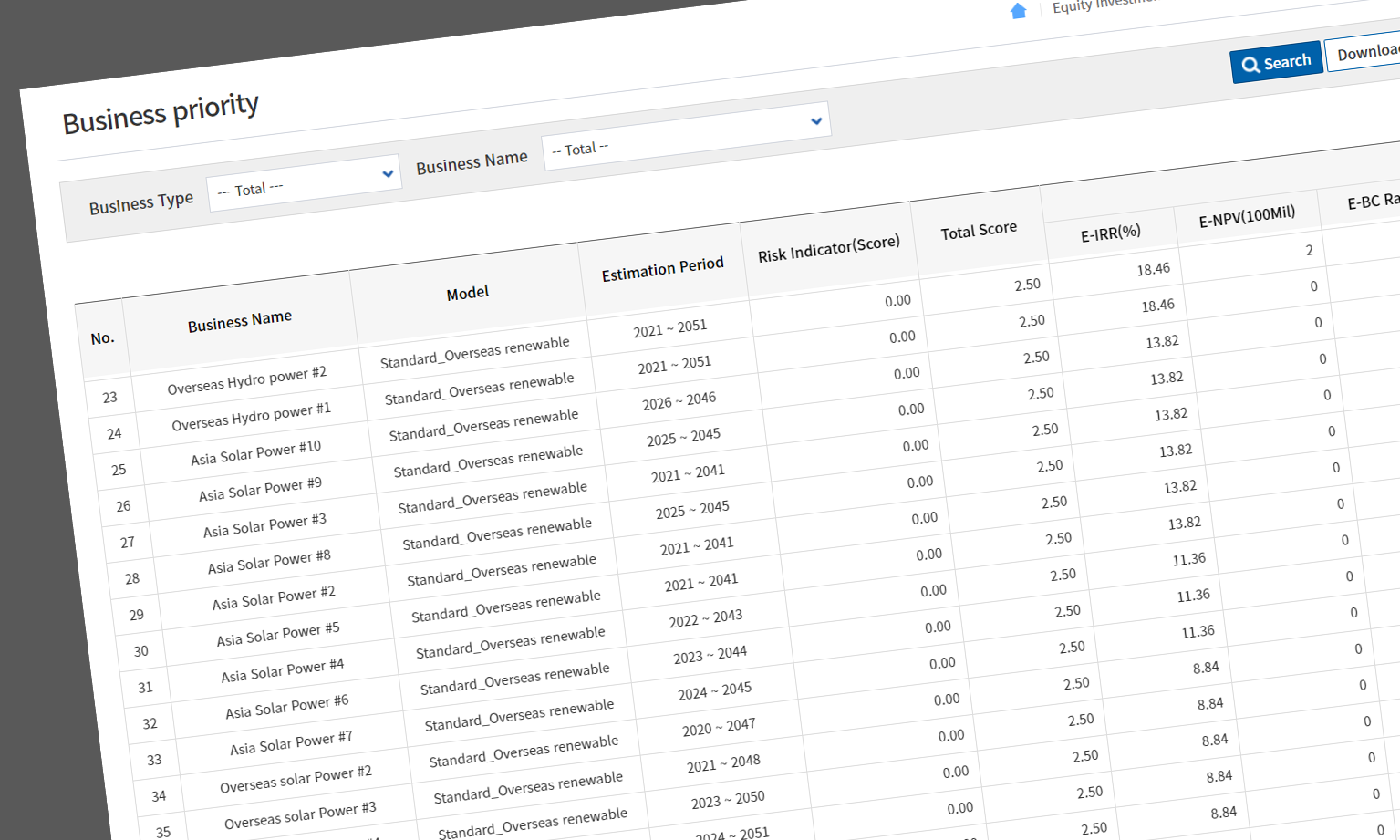

- Priority sorting by investment project monitoring

economic performance index/risk index/total score

- Economic analysis by business type

- Profitability x Risk Matrix Analysis by investment project

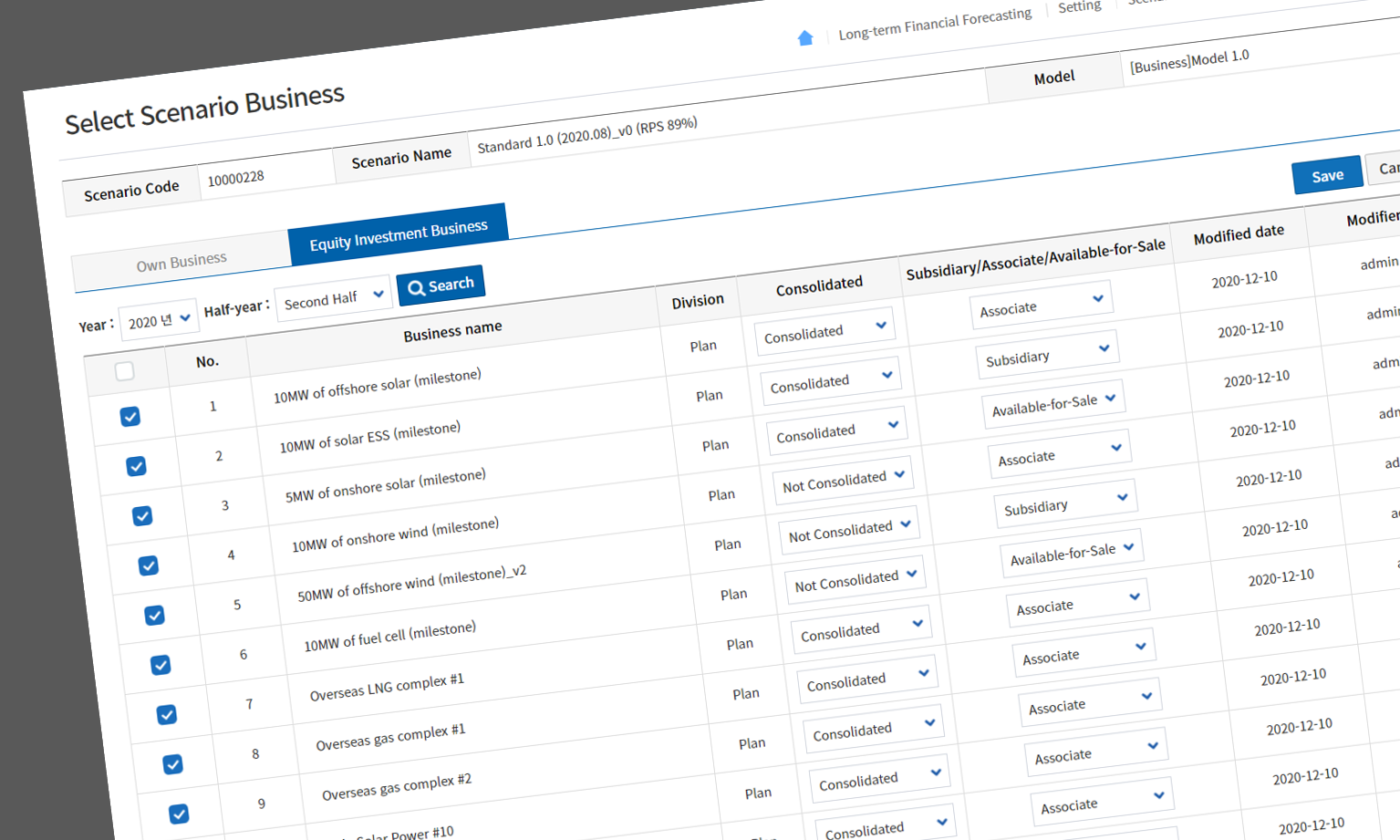

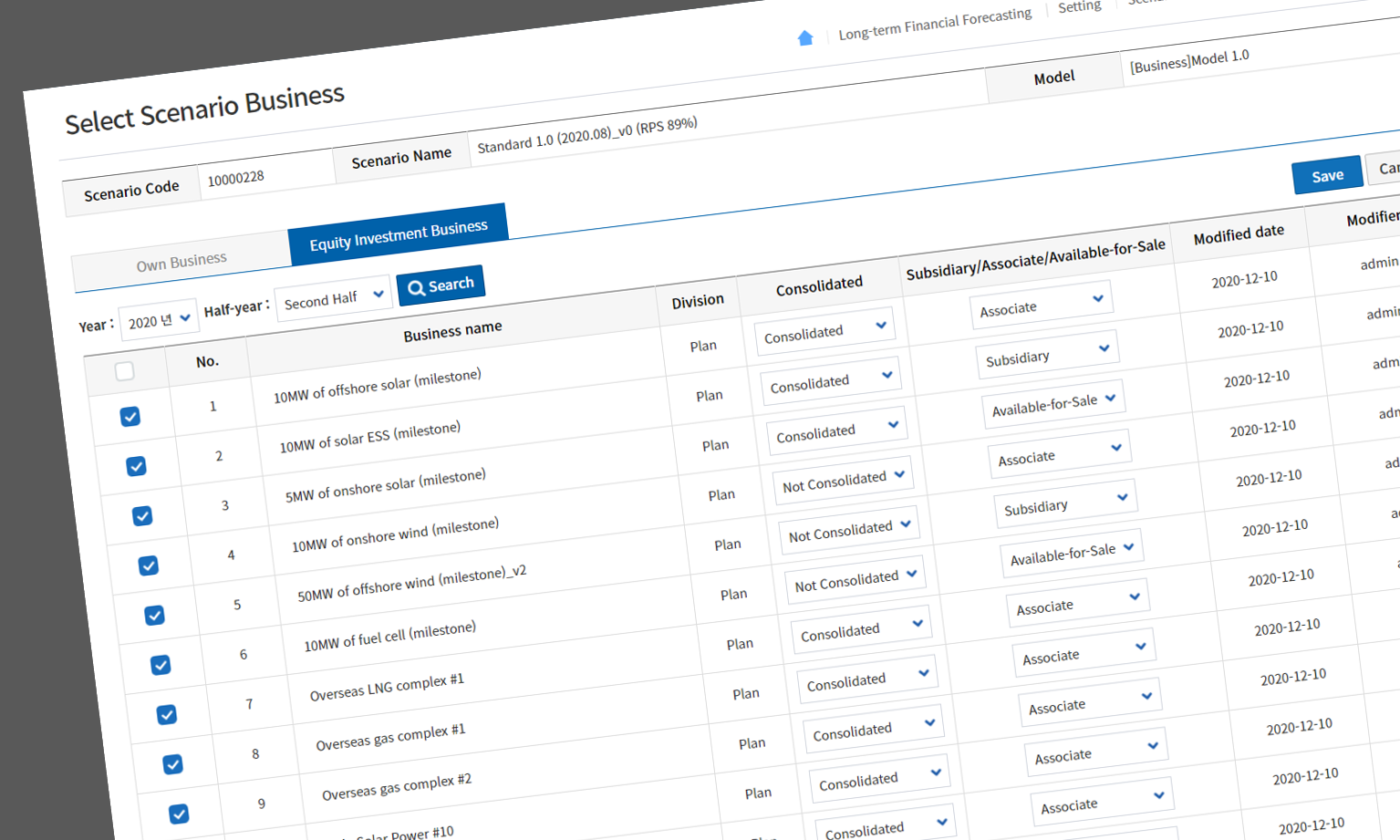

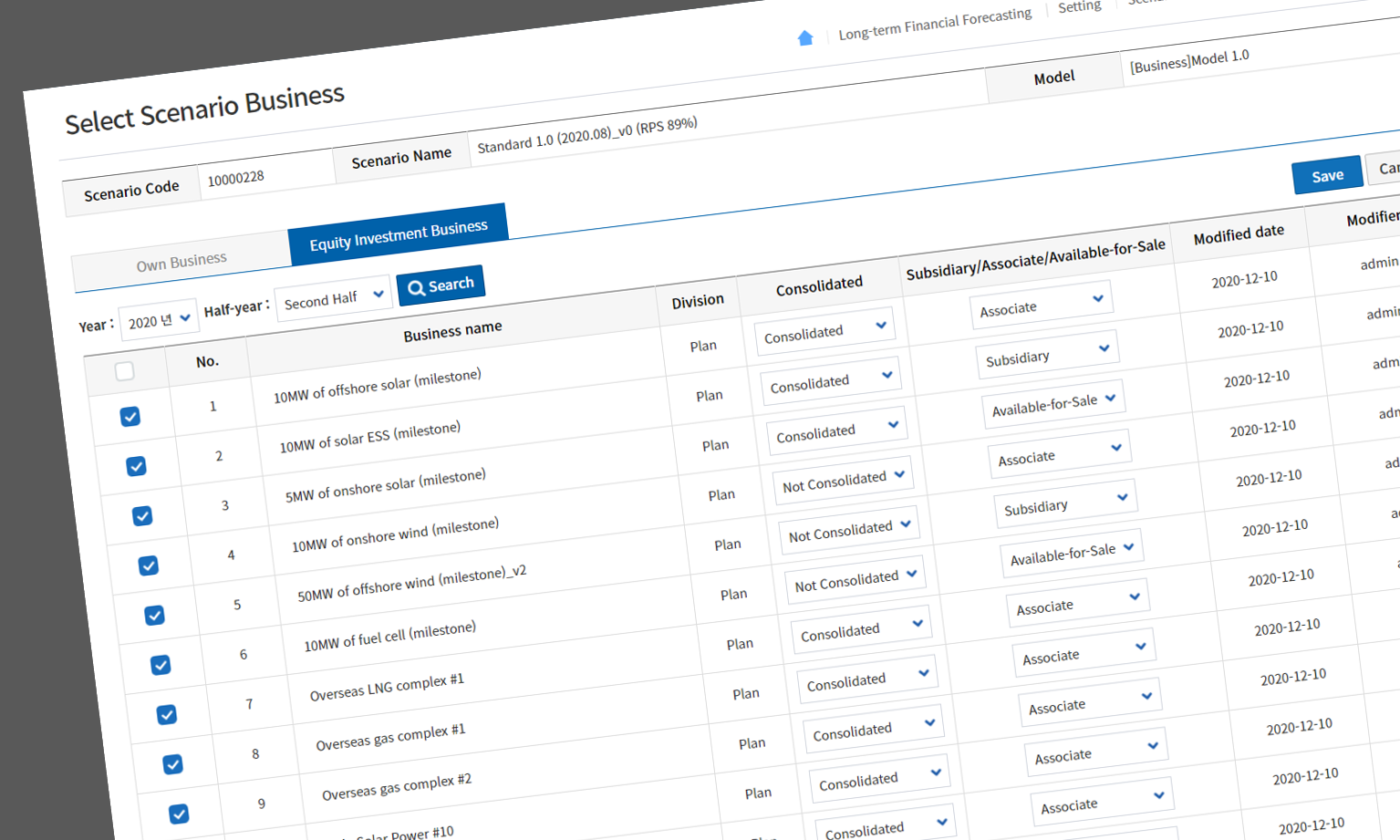

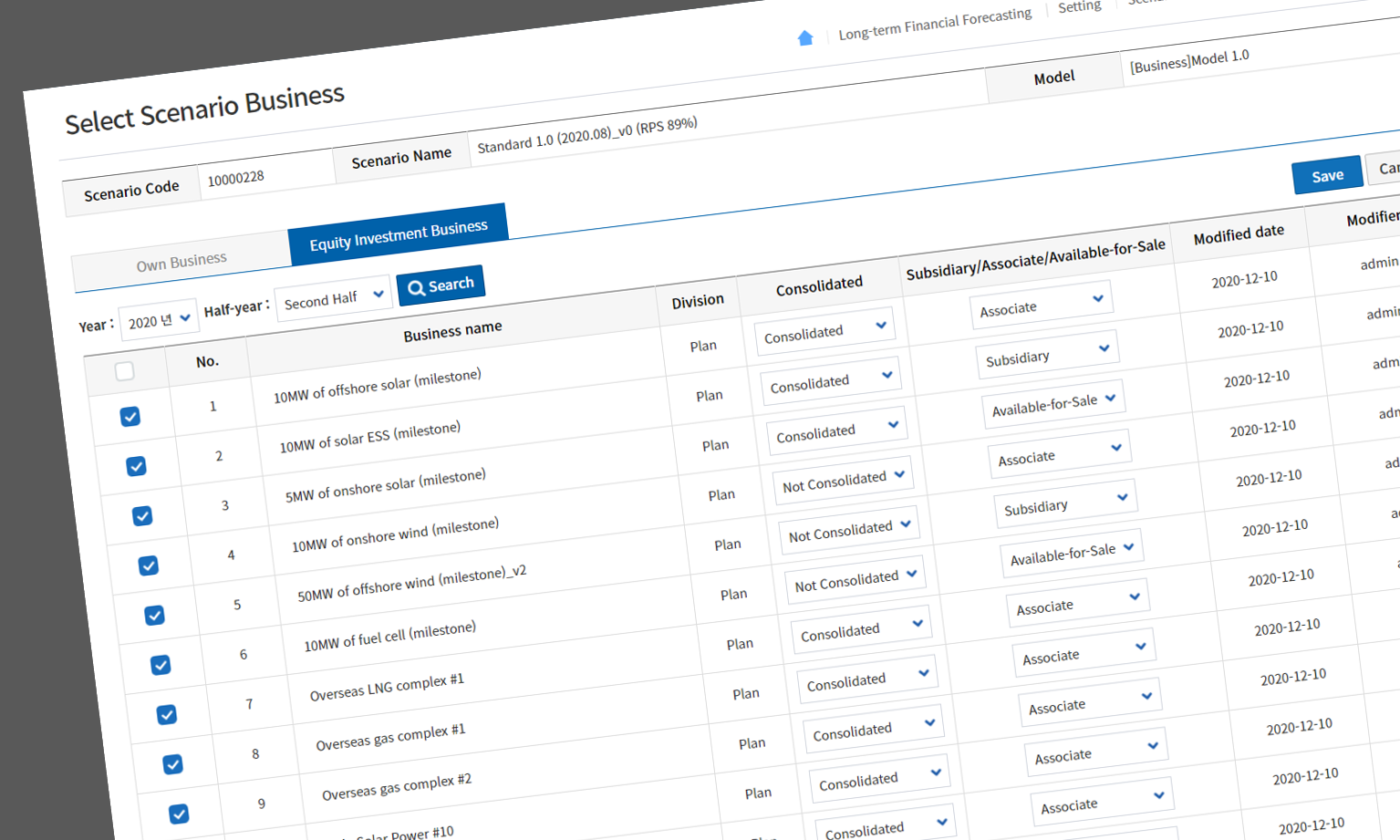

- Business portfolio composition considering business priority

- Creation of various business portfolio composition scenarios according to business strategy

- Flexible response to frequent business portfolio changes

- Verification of Investment capability according to business portfolio composition

- Strategic allocation of company-wide resources

- Fine management of business plans to achieve strategy goals

- Business Portfolio Goal/Prediction/Gap Monitoring

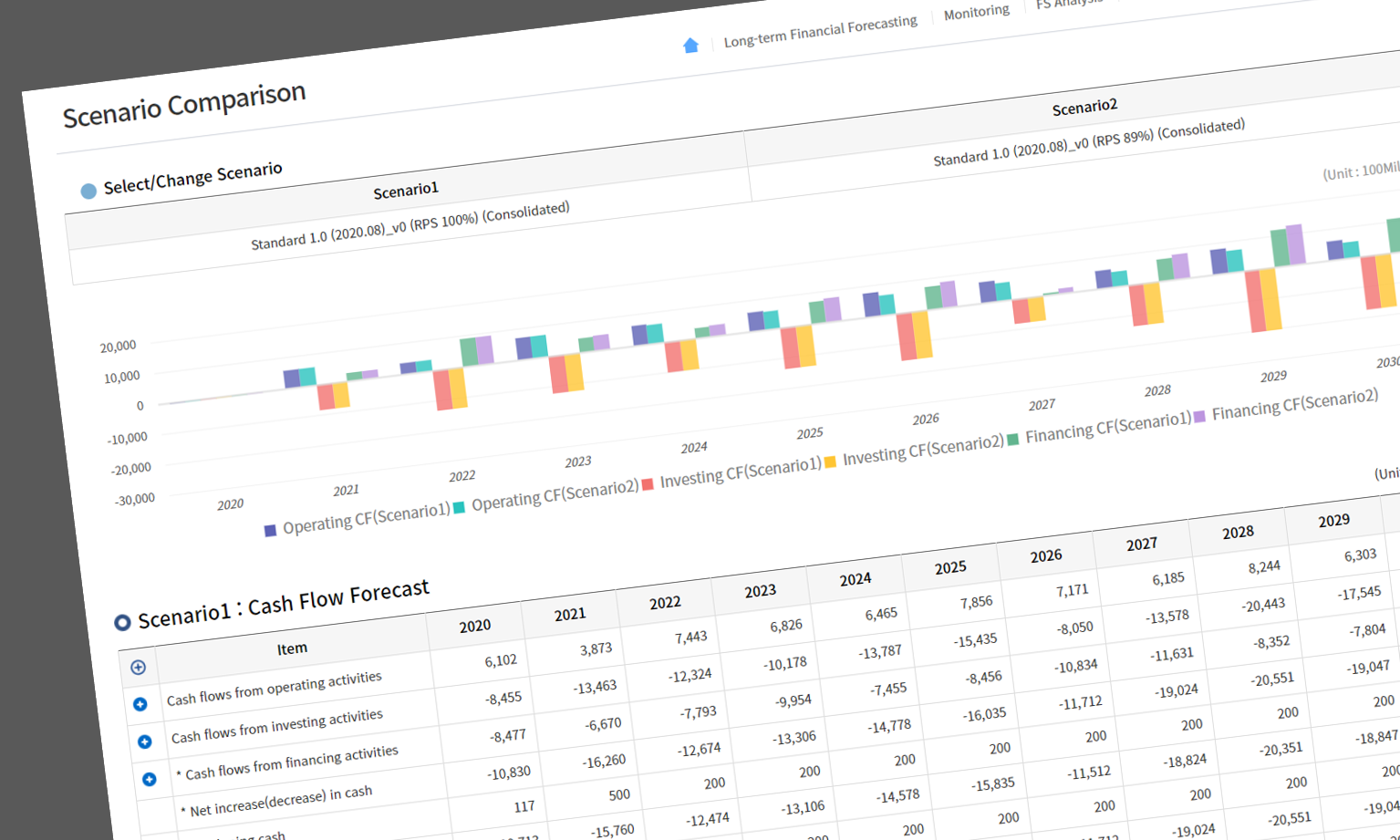

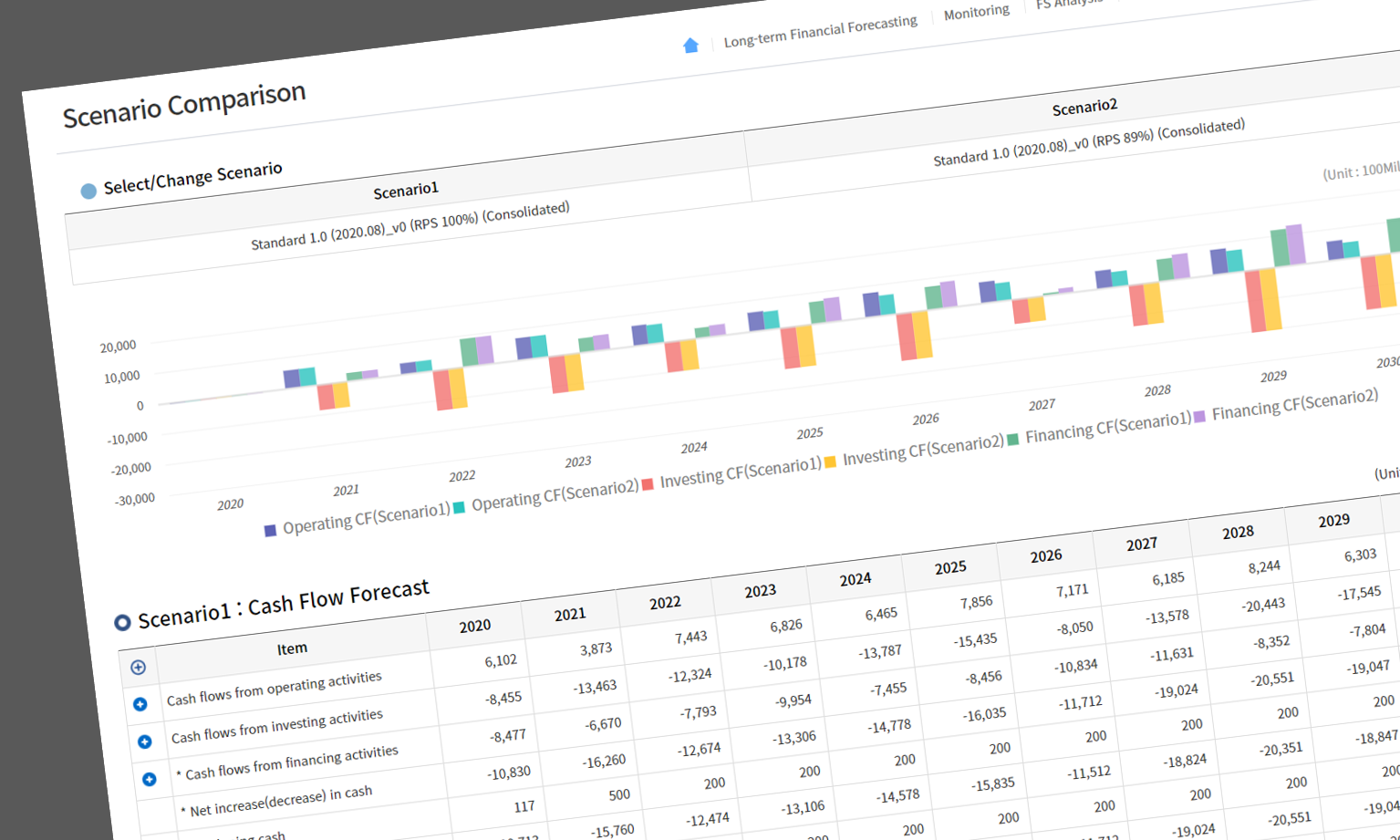

- Estimated Financial Forecast by Scenario

(Separate/Consolidated/Dependent/Consolidated Adjustment)

- Detailed monitoring of each estimated FS account

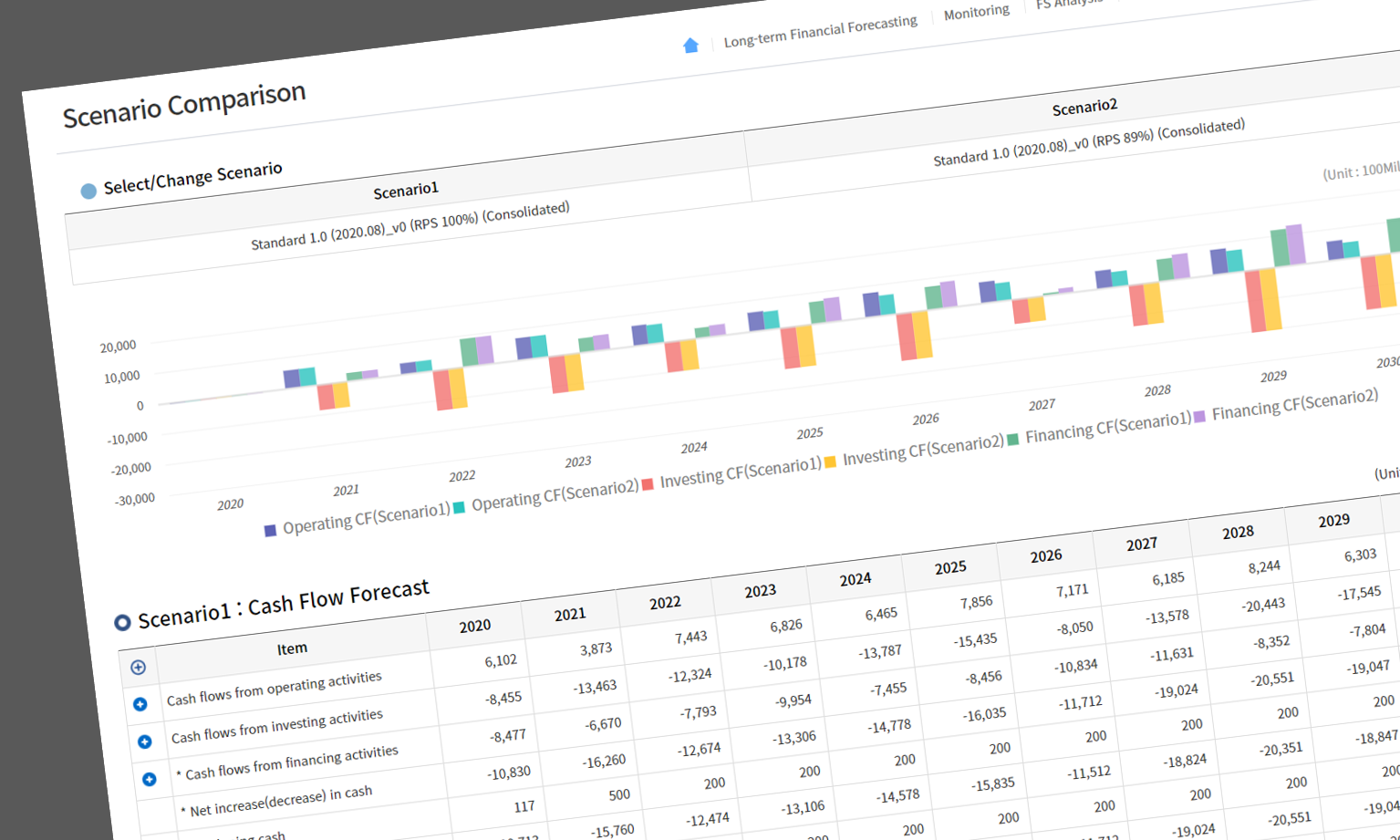

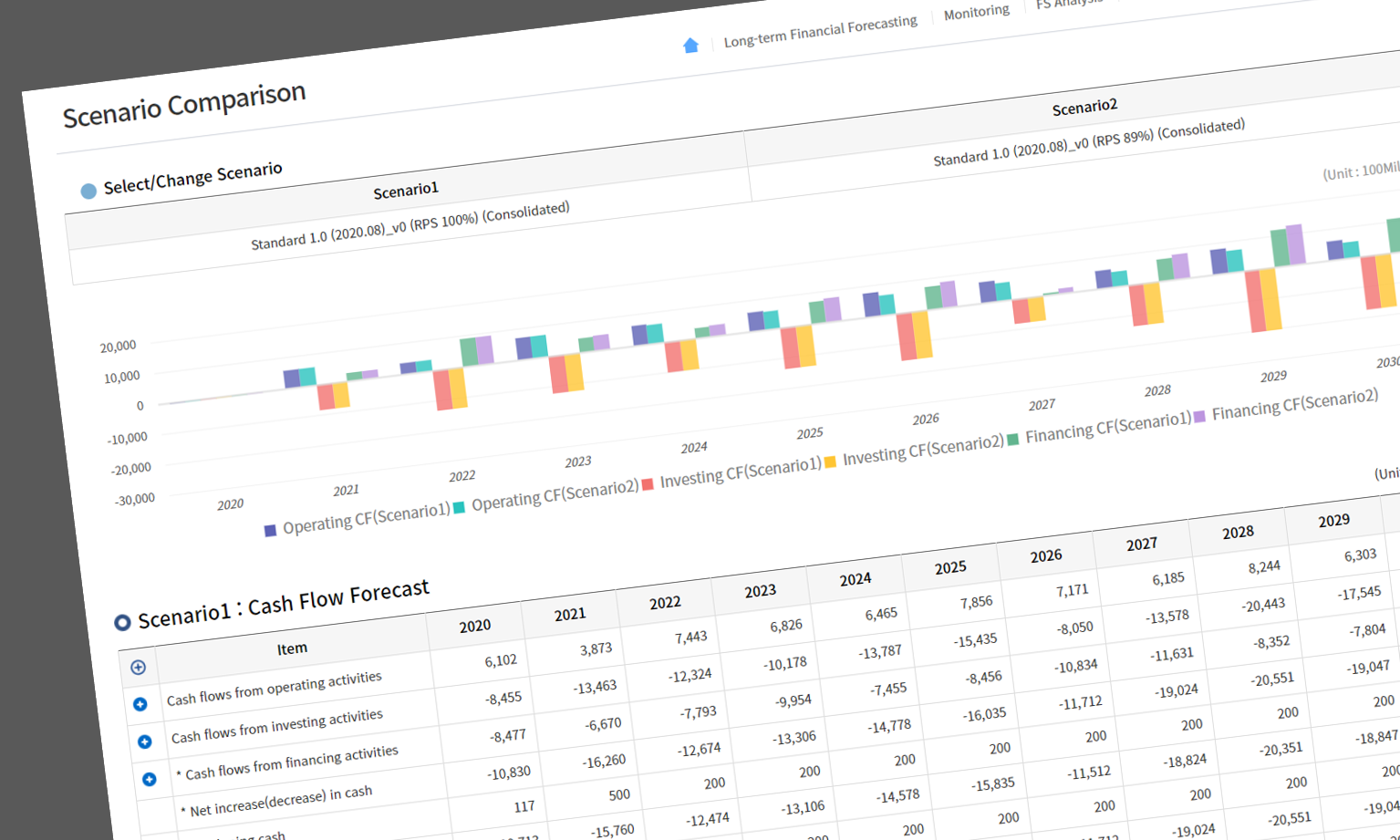

- Comparative analysis by scenario, deriving optimal alternatives

- Forecast of External environment impact, Verification of crisis response plan

FSM Main Function

- Strategic goal linkage: Business goal/Financial goal

- Investment plan prediction: CAPEX/Investment capacity

- Financial plan prediction

- Monitoring whether goals are achieved by financial management indicators

- Check basic information for each investment business Business

structure/profit assumptions/investment costs/financing

- Check the results of financial forecast by business

Check the results of financial forecast by business Cash flow/estimated financial statement

- Business Feasibility Analysis: IRR/NPV/BC Ratio

- Priority sorting by investment project monitoring

economic performance index/risk index/total score

- Economic analysis by business type

- Profitability x Risk Matrix Analysis by investment project

- Business portfolio composition considering business priority

- Creation of various business portfolio composition scenarios according to business strategy

- Flexible response to frequent business portfolio changes

- Verification of Investment capability according to business portfolio composition

- Strategic allocation of company-wide resources

- Fine management of business plans to achieve strategy goals

- Business Portfolio Goal/Prediction/Gap Monitoring

- Estimated Financial Forecast by Scenario

(Separate/Consolidated/Dependent/Consolidated Adjustment)

- Detailed monitoring of each estimated FS account

- Comparative analysis by scenario, deriving optimal alternatives

- Forecast of External environment impact, Verification of crisis response plan

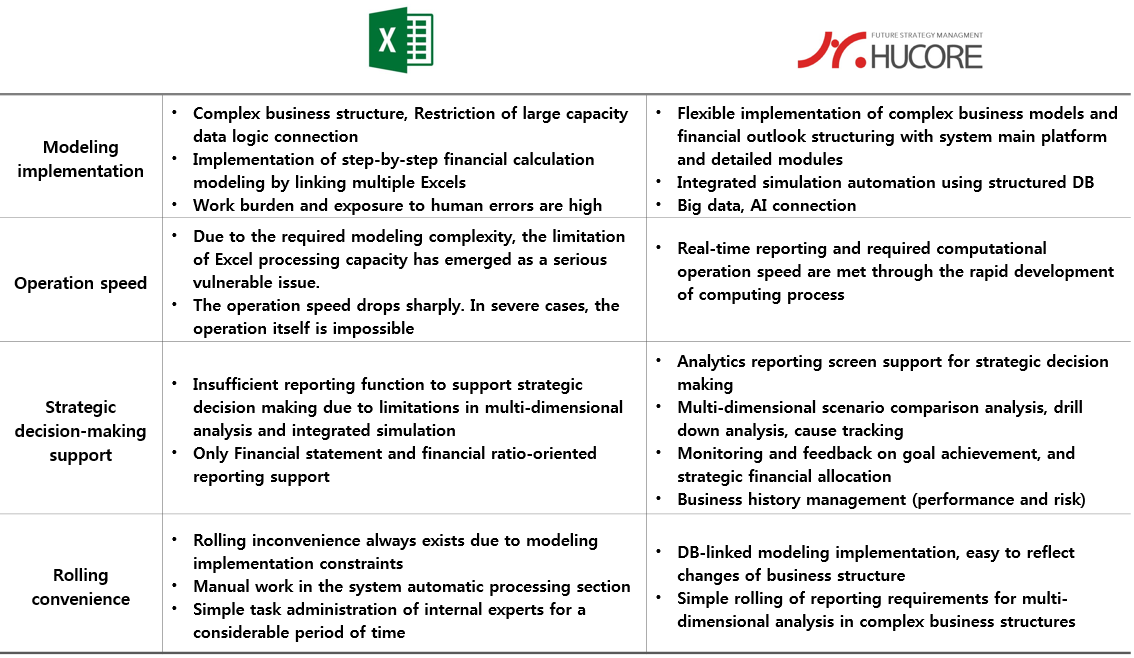

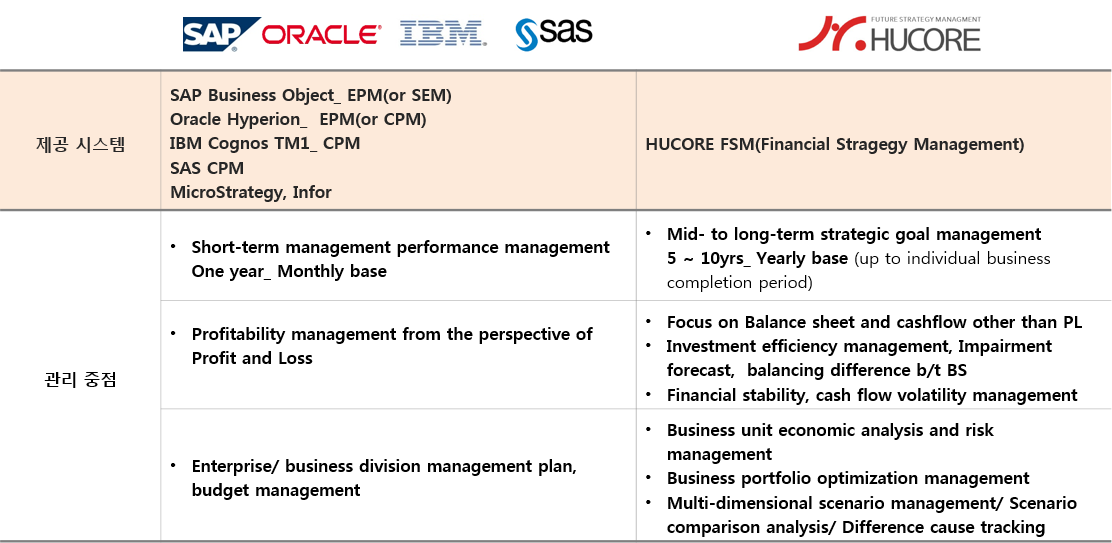

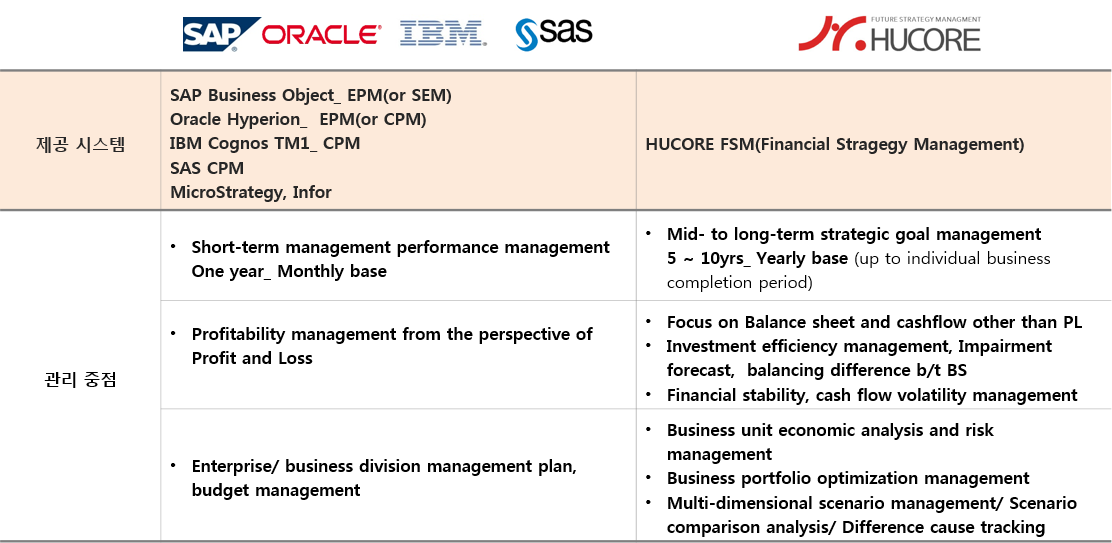

Global System vs. HUCORE FSM

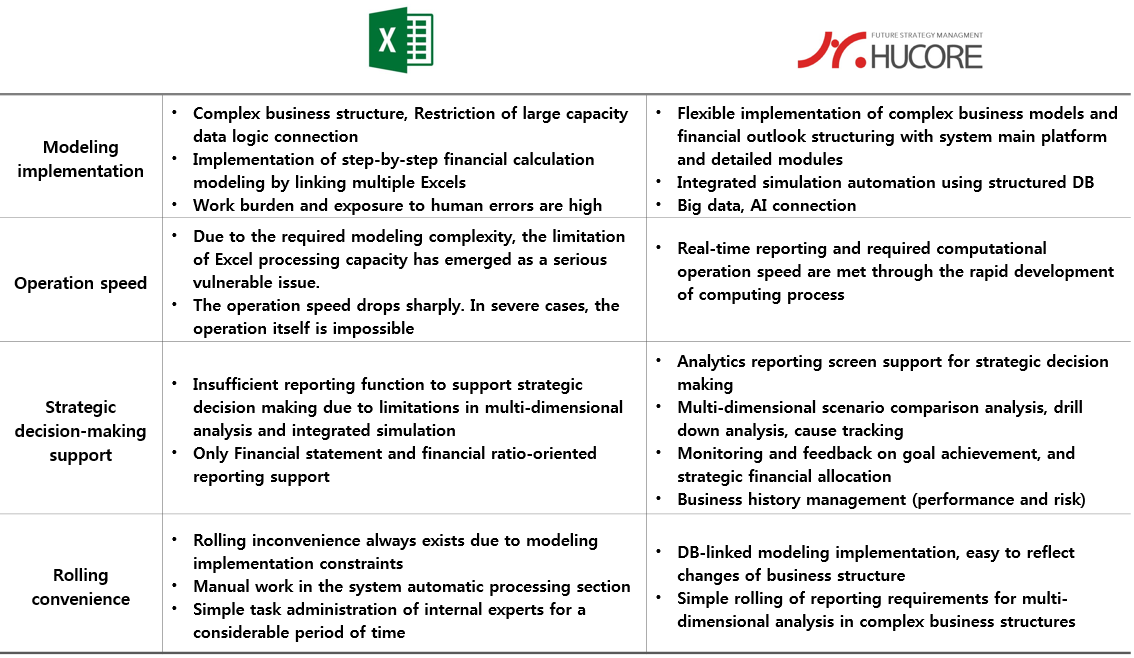

Excel vs. HUCORE FSM